Center for Digital Finance and Technologies Ribbon-cutting was held on Friday, November 4, 2022, 10:00 AM - 3:00 PM at Beacon Conference Room, Northwest Corner Building, Columbia University.

Image Carousel with 12 slides

A carousel is a rotating set of images. Use the previous and next buttons to change the displayed slide

-

Slide 1: 7323

-

Slide 2: 7325

-

Slide 3: 7326

-

Slide 4: 6989

-

Slide 5: 7022

-

Slide 6: 7291

-

Slide 7: 7238

-

Slide 8: 7163

-

Slide 9: 7063

-

Slide 10: 6951

-

Slide 11: 6948

-

Slide 12: 7294

Agenda

10:00 AM - Agostino Capponi & Garud Iyengar, Columbia Engineering

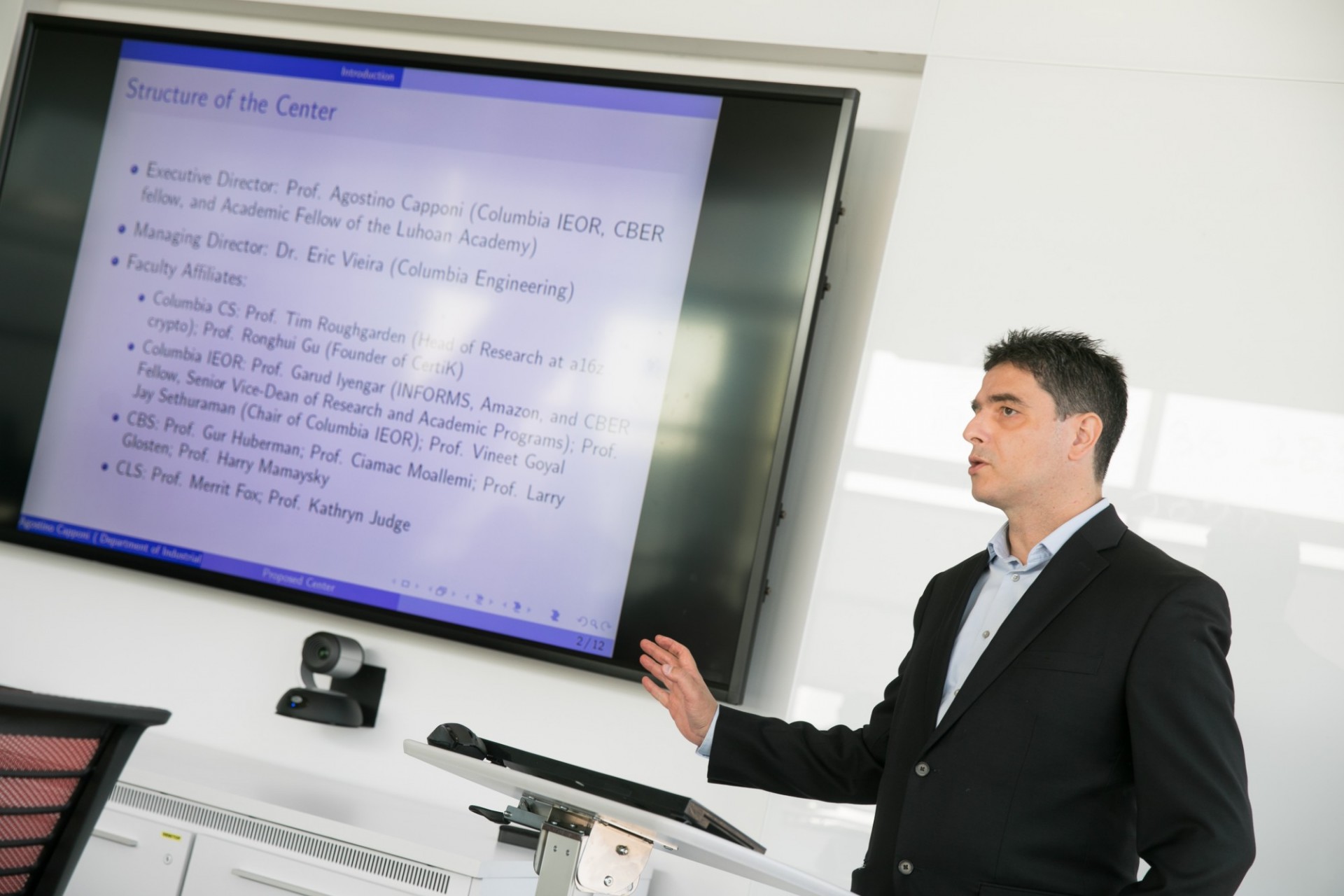

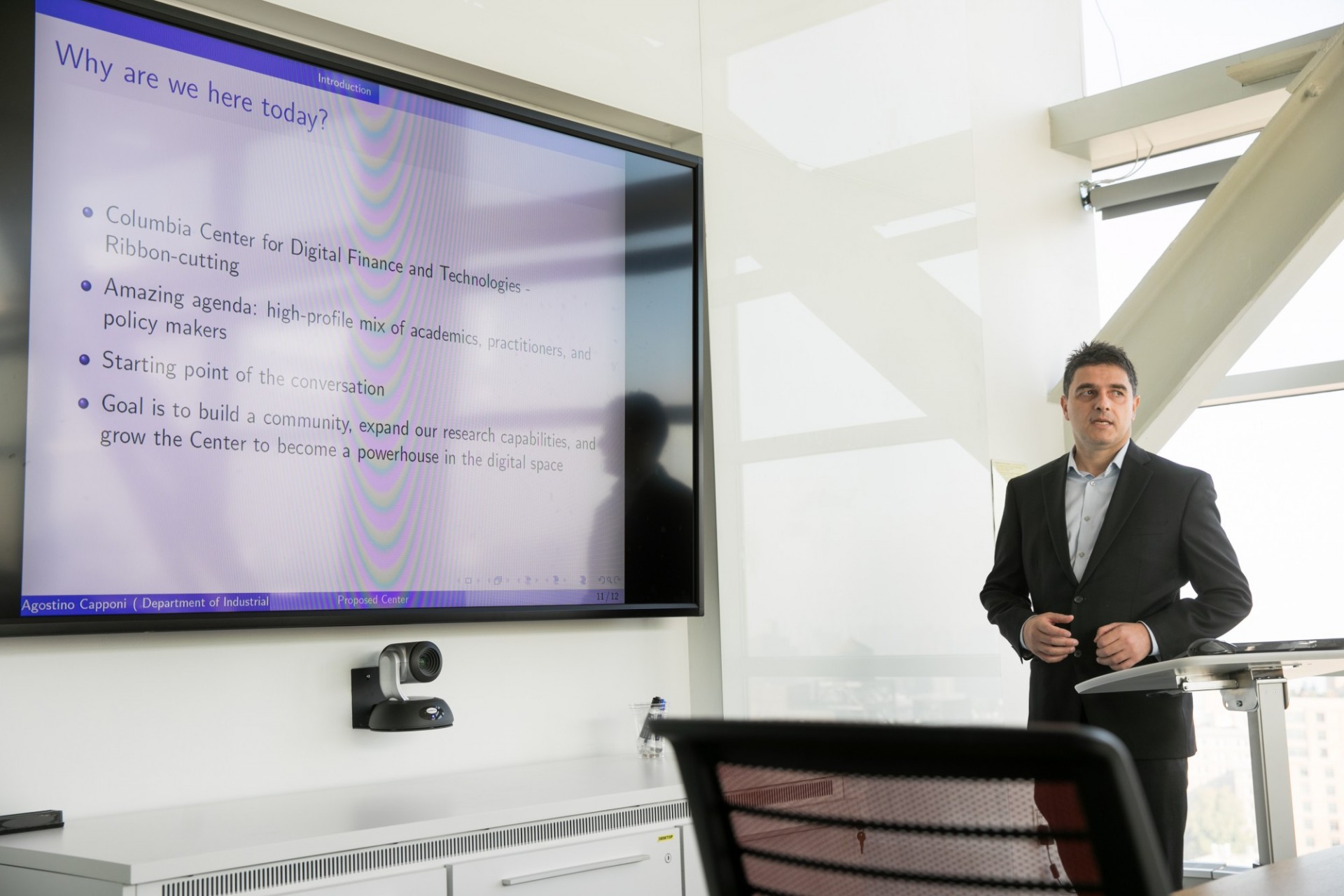

10:15 AM - Agostino Capponi, Columbia Engineering

Introduction

Agostino Capponi introduces the Center’s mission, objectives, and its structure. Then he mentions the ongoing activities at the Center, which include Digital Finance Seminar series run jointly with the Briger Family Digital Finance Lab at the CBS and the third edition of the premier conference on Blockchain and Economic Research (CBER 2023), joint with the Briger Family Digital Finance Lab. In addition, he introduces the ongoing research at the Center, including decentralized finance, miner extractable value, analysis of blockchain consensus protocols, regulations of distributed ledger technologies, and stablecoins, which have been covered by press such as Bloomberg, Financial Times, and Politico. At last, he kicks off the event.

10:15 AM - Tyler Holmes, Ethereum Foundation

“Post Merge Ethereum”

Tyler Holmes discusses the “Ethereum Roadmap”: a series of past and future upgrades to the Ethereum blockchain. The most recent upgrade “The Merge” changes Ethereum's consensus algorithm from Proof-of-Work (PoW) to Proof-of-Stake (PoS), which brings improvements to the Ethereum ecosystem in aspects of sustainability, security, and decentralization. Future upgrades to Ethereum include “The Surge”, “The Verge”, “The Purge” and “The Splurge”. “The Surge '' aims to scale Ethereum for both data and computational throughput by sharding. “The Verge '' aims to make Ethereum stateless through Verkle trees. “The Purge” aims to eliminate historical data and technical debt. “The Splurge” will implement other improvements not covered by the previous upgrades.

10:30 AM - Ciamac Moallemi, Columbia Business School

“The Economics of Liquidity Provision”

In recent years, automated market makers (AMMs) such as Uniswap have emerged as the dominant mechanism for the decentralized trading of risky assets on blockchains. On the Ethereum blockchain, for example, such decentralized exchanges are the single most popular "application category" implemented through smart contracts. Ciamac Mollemi discusses the economics of passive liquidity provision on AMMs and contrasts them to electronic limit order books (LOBs), which are the dominant market structure for traditional, centralized exchange-based electronic markets. He proposes that the return to liquidity providers (LPs) on AMMs consists of three components: a trading fees component which systematically makes money, a hedgeable market risk component, and a what’s called “loss-versus-rebalance (LVR)” component, which reflects adverse selection costs to LPs.

11:00 AM - Frank Fan, Arcane Group

“Bridging East and West in Web3”

Frank Fan provides an overview of the characteristics, history, and current state of the Asian cryptocurrency industry. He argues that the Asian cryptocurrency industry features large potential markets, high-quality talents, and ample resources, and thus is able to produce high-quality Web3 products for a global user base. While the Asian cryptocurrency industry has opportunities such as strong web3-supporting infrastructure, weak TradFi infrastructure, and high mobile/internet penetration, it faces multiple challenges including underrepresentation, heavy regulations, and weak capital support. In addition, he introduces Arcane, its investment philosophy, and its role as an Asia-based fund in empowering innovators in the region and supporting outstanding overseas projects and funds to launch in Asia and grow the Web3 movement.

11:15 AM - J. Austin Campbell, Paxos National Trust

“Current Developments in Crypto”

J. Austin Campell discusses the integration of crypto into the real world in terms of payments and on-chain real assets: increasing usage of crypto rails for payments is driving more real assets onto the blockchain; more real assets on the blockchain is driving demand for crypto payments. He then introduces some use cases. For example, crypto payments with stablecoins are instant, global, composable, flexible, and backward compatible with traditional finance. In addition, crypto is increasingly used for real stuff such as banking (e.g., UDST integrated into SmartPay in Brazil), on-chain stores of value (e.g., PAXG and others create the ability to own gold in London Vaults), and funding (e.g., hedge funds borrowing in DeFi and lending in TradFi).

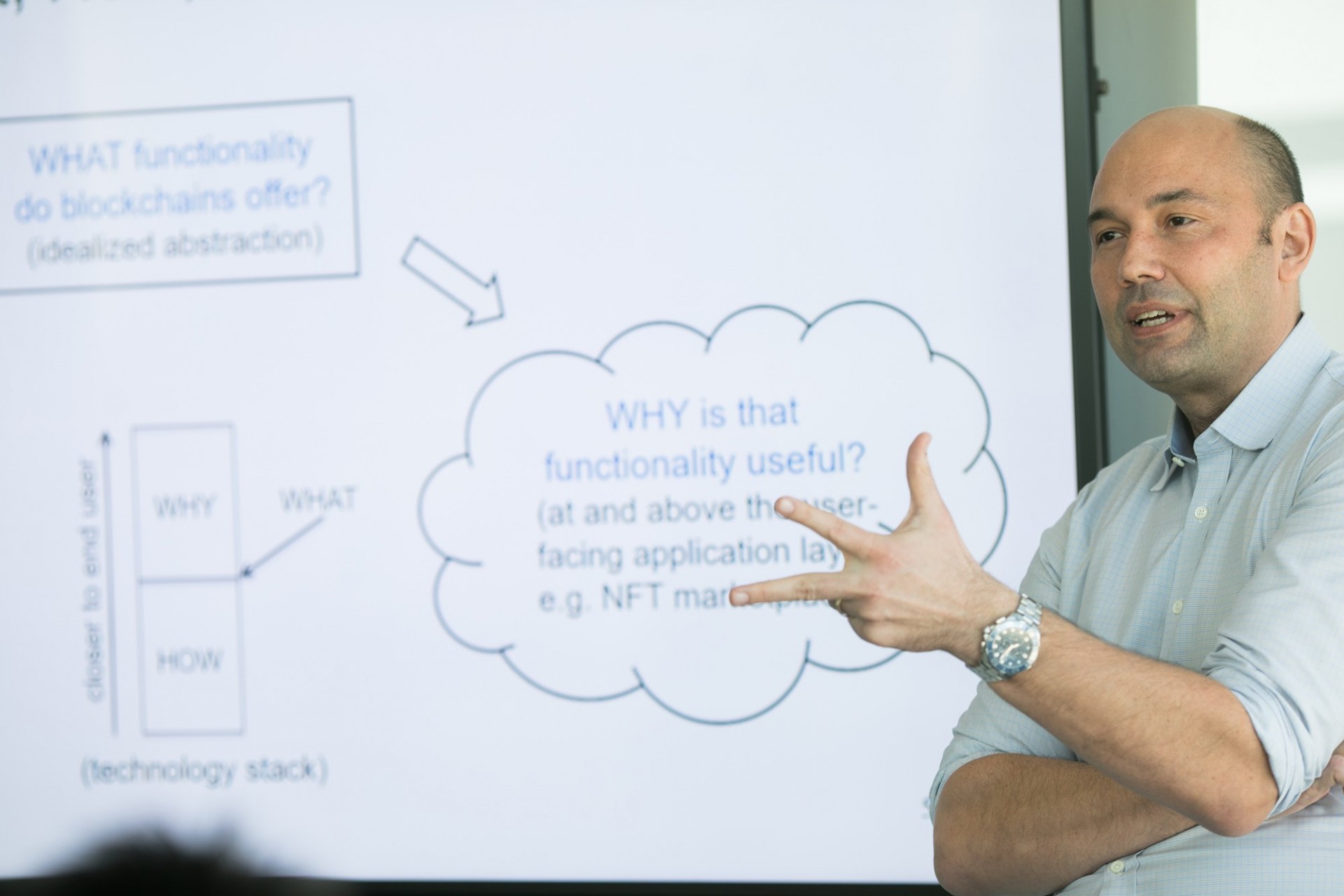

11:30 AM - Tim Roughgarden, Columbia University

“Web3 and the Evolution of the Internet”

Tim Roughgarden discusses the WHAT, HOW, and WHY of blockchains and Web3. Specifically, WHAT functionality do blockchains offer? HOW is that functionality implemented (below the user-facing application layer, e.g., PoW vs. PoS)? WHY is that functionality useful (at and above the user-facing application layer, e.g., NFT marketplaces)? He then focuses on the WHAT part and offers his idealized abstraction of (Turing-complete) blockchain functionality: 1) a general-purpose computer; 2) no owner or operator; 3) anyone can deploy new applications or use existing ones; 4) supports user-owned data, enforces property rights.

1:00 PM - Ronghui Gu, Columbia Engineering

“Securing the Web3 World”

As the adoption of blockchain continues to grow, new security risks appear in areas, e.g., cross-chain bridges, smart contract vulnerability, and governance attacks, which all can lead to significant monetary loss. In contrast to existing approaches which either provide a very low-security rate or require huge manual effort, Ronghui Gu presents the tools and products at CertiK to scale the code auditing and blockchain monitoring.

1:15 PM - Shai Halevi, Algorand Foundation

“Private Computing on Public Blockchains”

Public blockchains have emerged over the last decade as a promising architecture for distributed computing. Using "smart contracts" with public execution backed by agreement protocol, public blockchains provide a computing environment with highly dependable results. However, the public nature of this architecture also makes it challenging to use secret data in the computations. Shai Halevi surveys a line of recent works on storing and processing secret information on public blockchains. The main tool is a flavor of secure multiparty computation (MPC) that he calls YOSO - "You Only Speak Once".

1:30 PM - Antoine Martin, Federal Reserve Bank of New York

“Distinguishing money and exchange mechanism”

Antonie Martin argues that when thinking about digital assets, it is important to distinguish between the type of “money” they represent and the “exchange mechanism” on which they can be transferred. The type of “money” is related to what makes the asset a good store of value and includes fiat money, money backed by assets, and money backed by unsecured claims. While the “exchange mechanism” is related to the asset’s function as a medium of exchange and includes physical transfer, electronic with a trusted third party either with a centralized database or permissioned DLT, and electronic without a third party (permissionless DLT). Such framing helps better understand the nature of various digital assets. For example, Bitcoin is not a new type of money, but the exchange mechanism is new. In addition, the distinction between stablecoins and Alipay/Tenpay is in the transfer mechanism, not the type of money. Then he poses the question: if DLTs turn out to be the better exchange mechanism, what is the best money for DLTs?

1:45 PM - Asani Sarkar, Federal Reserve Bank of New York

“Stopped Capital: Using Bitcoin to Avoid Capital Controls”

Asani Sarkar provides evidence consistent with residents buying bitcoin in China and selling them for US dollars on non-Chinese bitcoin exchanges, thereby using bitcoin to evade capital controls. Specifically, he shows that, during the sample period of 2014-2016, on Chinese bitcoin exchanges, the Bitcoin price premium and the buy imbalance increased with a measure of capital control. Conversely, on foreign exchanges, the Bitcoin price discount and the sell imbalance increase with the measure of capital control. He highlights the prominent role of Bitcoin in evading capital controls during his sample, when Chinese capital controls were strict, and when most bitcoin trading also occurred in China.

2:15 PM - Bruce Choy, Global Risk Institute

“Navigating the risks of financial innovation”

Financial innovation is important to increase efficiency in the movement of capital, allow broader access to financing, and increasingly ensure consumers’ protection so they have a better picture of their financial well-being. However, any disruption not only brings opportunity but also carries risk. Bruce Choy argues that it is important to look at these innovations from at least three different risk management perspectives: (a) the critical path and its challenges to operationalizing the financial innovation, (b) what happens if our assumptions are incorrect (i.e. unintended consequences), and (c) what recourse, actions or backstops, are needed to be put in place for when thing fail. Comprehensive risk management must go hand-in-hand with innovation.

2:30 PM - Lauren Weymouth, Ripple

“Accelerating Blockchain to Fuel the Future of Work”

Lauren Weymouth provides a brief overview of Ripple, the company, and the products and services (RippleNet, XRP) it offers. Then she dives deep into University Blockchain Research Initiative (UBRI), a vehicle through which Ripple fosters research, talent, and innovation, and builds a scalable, global blockchain ecosystem and the FinTech workforce of the future. In addition, she further mentions that Ripple adds impact by achieving powerful collective results such as technical research projects, new and modified fintech courses, by offering a UBRI podcast, implementing UBRI actions (research in CBDCs, RippleX Tooling, sustainability), and organizing the UBRI Connect academic conference.

2:45 PM - Brett Mollin, Ripple

“CBDC Sidechain Topologies”

When looking at a national digital currency, central banks have needs beyond the current performance of public blockchain solutions. Most scaling methods for these solutions involve sharding or sidechain technology. The key to scaling efficiently is designing a system that most often communicates within the shard/chain and infrequently cross-chain. Brett Mollin discusses the problem and the pros and cons of the various choices when designing a CBDC network composed of multiple side chains. The key observation is that cross-chain transactions reduce capacity. While many technologies are used for bridging chains, all add overhead to complete a cross-chain transaction. To scale via side chains/sharing/subnets, a network topology needs to be designed the minimize cross-chain transactions. But there are many choices including side chains for geographic regions, side chains by private institutions, etc.

3:00 PM - Agostino Capponi, Columbia Engineering

The full program book of the event can be found here.